5 Halal Semiconductor Stocks for Responsible Muslim Investors

Tayyib Finance introduces the best performing halal stocks that are also sustainable, empowering modern Muslims to invest conscientiously.

A tiny piece of material that has made computing as we know it possible and is still turning our lives ever more digital, semiconductors are expected to continue growing in clout in decades to come, parlaying into geopolitics. So long-term you really can’t go far wrong with semiconductor stocks. Here is a list to consider for a Muslim investor.

Interlude: The selection criteria

All stocks on Good Finance fulfil the same basic criteria, in two areas. First, Shariah prescriptions which automatically eliminate companies in haram industries and those that exceed the stipulated debt or interest thresholds. To be tayyib, the remaining businesses also need to clear minimum environmental, social and governance (ESG) standards: at the very least, they shouldn’t profit from anything that is clearly damaging to the planet or its inhabitants. The other aspect is financial performance; I stick with the fundamentals to narrow down to businesses with a record of stable and reliable growth.

Note: NVIDIA from the list below is among the tech stocks implicated in supporting Israel’s apartheid regime in Palestine.

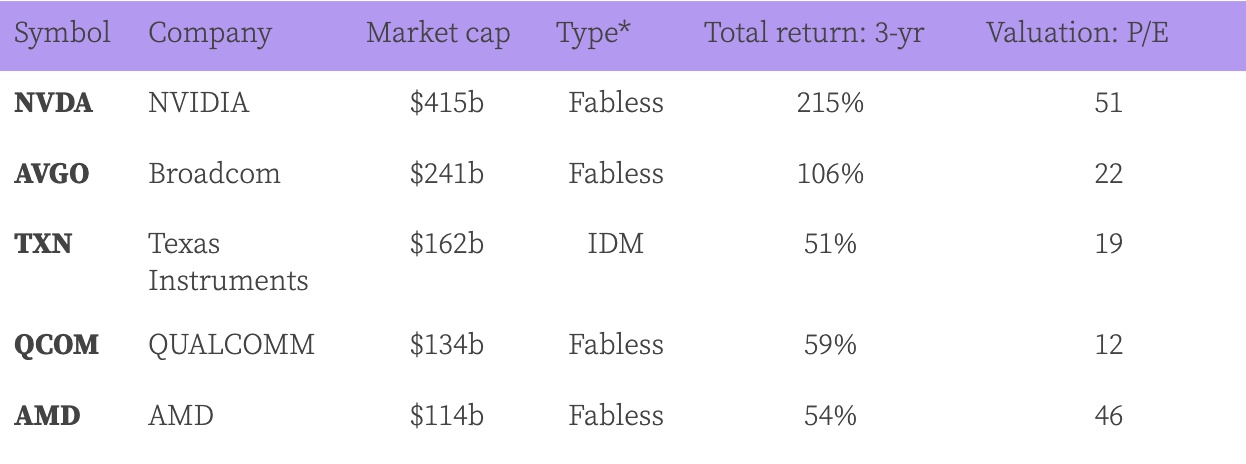

NVIDIA (NASDAQ: NVDA)

Revenue growth (compounded 3-year average): 42%

Earnings growth (compounded 3-year average): 34%

Median earnings growth forecast: 27.1% per year

Total shareholder returns (3-year): 215.5% [industry: 63.8%]

Price/Earnings (trailing 12-month as of 25 January): 51.22

NVIDIA Corporation is a developer of high-performance graphics processing units for computers and servers used in gaming, design, data, cryptocurrency and manufacturing. Analysts are mostly enthusiastic about the stock citing secular tailwinds in AI across verticals as well as new opportunities in areas such as metaverse.

Broadcom (NASDAQ: AVGO)

Revenue growth (compounded 3-year average): 14%

Earnings growth (compounded 3-year average): 60%

Median earnings growth forecast: 7.5% per year

Total shareholder returns (3-year): 106.5% [industry: 63.8%]

Price/Earnings (trailing 12-month as of 25 January): 21.82

Broadcom produces semiconductors and software for the wireless and broadband communication industry. It enables devices’ Bluetooth connectivity, routers, switches, processors and fibre optics. Investors like the stock for a growing dividend (about 3% currently) and a relatively inexpensive price.

Texas Instruments (NASDAQ: TXN)

Revenue growth (compounded 3-year average): 11%

Earnings growth (compounded 3-year average): 21%

Median earnings growth forecast: -0.4% per year

Total shareholder returns (3-year): 51.3% [industry: 63.8%]

Price/Earnings (trailing 12-month as of 25 January): 18.82

Texas Instruments makes semiconductors for electronics designers and manufacturers. It mainly offers analog chips and embedded processors for computing activities. Given its wide economic moat, the company is recommended for long-term investing.

QUALCOMM (NASDAQ: QCOM)

Revenue growth (compounded 3-year average): 22%

Earnings growth (compounded 3-year average): 47%

Median earnings growth forecast: 4.6% per year

Total shareholder returns (3-year): 59.5% [industry: 63.8%]

Price/Earnings (trailing 12-month as of 25 January): 11.72

QUALCOMM specialises in designing wireless communications products including 5G. It also provides services related to its patented CDMA technology. Analysts are overwhelmingly bullish at present given the stock’s low valuation but solid business prospects.

Advanced Micro Devices (NASDAQ: AMD)

Revenue growth (compounded 3-year average): 56%

Earnings growth (compounded 3-year average): 101%

Median profit growth forecast: 35.6% per year

Total shareholder returns (3-year): 53.6% [industry: 63.8%]

Price/Earnings (trailing 12-month as of 25 January): 45.97

Advanced Micro Devices designs and manufactures microprocessors, GPUs and other hardware components for personal computers, enterprise servers and game consoles. Although the stock is not cheap, bulls expect the company to continue growing fast in strategic segments.

Takeaway

These five halal stocks are slightly different in parameters but since they all make semiconductors — an industry on the up and up — each one has a potential to perform. If you were to time an entry, QCOM is the lowest priced peer at the moment. Its earnings growth forecast, however, pales in comparison to those of more expensive NVDA and AMD.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.