Halal AI Stocks That Also Pay Dividends

Not only do these Islamic stocks give exposure to the hottest investment trend, they also deliver steady dividend checks.

Generative artificial intelligence has been all the rage recently. That has not been lost on the investing world. While a few of the large AI stocks are not Shariah compliant (or questionable) — like Microsoft, Alphabet, Meta and IBM — plenty are halal, which allows Muslim investors to ride the trend as well.

Since many tech firms driving the AI industry revolution have already seen their share prices shoot up, buying the big names at this time may not seem economical. With dividends, however, you are bound to keep receiving, even without much capital gain. And as far as that goes, AI stocks that pay dividends fit perfectly, particularly those with a track record of growing payouts.

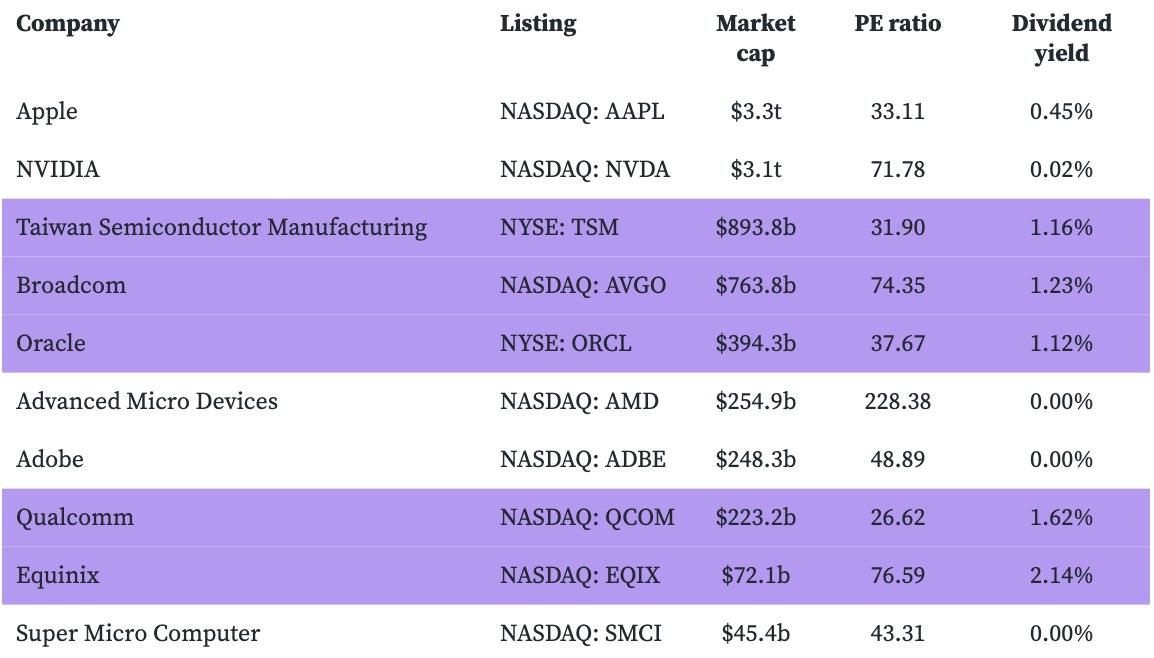

Here is my selection of some of the best AI stocks that are Shariah compliant and dividend paying:

Because technology companies in general are not known for dividends, AI stocks too either do not pay anything at all or, if they do, at tiny yields. From the ten halal equities above, only five have dividend yields exceeding 1%. Let’s look at them.

Note: NVIDIA and Oracle from the list above are among the tech stocks implicated in supporting Israel’s apartheid regime in Palestine.

Halal AI dividend stocks

Taiwan Semiconductor Manufacturing Company (NYSE: TSM)

Dividend yield (trailing 12 months): 1.16%

Dividend payout ratio: 38.82%

Dividend growth rate (5-year): 9.83%

Running the largest foundry, Taiwan Semiconductor Manufacturing supplies AI hardware to the apparently insatiable chip makers of the world. This industry leader — which Wall Street analysts recommend as a “Strong Buy” on momentum and profitability — continues to grow at a brisk pace that, in turn, supports its dividends.

Broadcom Inc. (NASDAQ: AVGO)

Dividend yield (trailing 12 months): 1.23%

Dividend payout ratio: 46.73%

Dividend growth rate (5-year): 15.97%

Another manufacturer of semiconductors, Broadcom could be considered an elemental part of the AI ecosystem. AI related revenue and profit have been climbing at double-digit rates, and this may last for sometime. The stock is rated highly for dividend safety and consistency, with payouts growing for 13 years in a row.

Oracle Corporation (NYSE: ORCL)

Dividend yield (trailing 12 months): 1.12%

Dividend payout ratio: 28.73%

Dividend growth rate (5-year): 14.58%

Oracle has experienced renewed growth thanks to its AI software and cloud solutions, chiefly Oracle Cloud Infrastructure. Five-year average earnings have expanded by 37%; the forward growth rate for diluted earnings is 12%. Dividend in the most recent financial year grew 11% and is forecast to increase by another 7.5% this year.

Qualcomm Inc. (NASDAQ: QCOM)

Dividend yield (trailing 12 months): 1.62%

Dividend payout ratio: 35.24%

Dividend growth rate (5-year): 5.56%

Qualcomm makes specialised AI chips for the telecom industry and other high-growth markets like autonomous vehicles and IoT. Revenues are geographically diversified too, with a major chunk coming from Asia. It boasts 20 years of annual dividend increases; in the next three years, the payout is expected to grow by 7%.

Equinix Inc. (NASDAQ: EQIX)

Dividend yield (trailing 12 months): 2.14%

Dividend payout ratio: 70.41%

Dividend growth rate (5-year): 11.30%

Equinix sits on the infrastructure side of things operating advanced data centres that power AI applications. Solid fundamentals and sustained growth have fed dividend payouts which have risen 11% in the last five years; dividend per share is forecasted to grow over 6% in the next three years against the forward revenue growth of 9%.

Takeaway

Although the benefits of AI are many, the nascent technology has its risks (and from an Islamic perspective too). That, of course, has not stopped investors from piling in on AI stocks. Most are big American companies — like all except one in this halal stock list. So then, naturally, month after month after month of heavy market attention, the stocks have gotten pricey. Some more than others.

Among the five halal AI dividend stocks featured here, EQIX and AVGO are the most expensive with price-to-earnings ratios of more than 70x. Note that EQIX, though, offers the highest dividend at 2.14%. There is QCOM on the other end of the spectrum, with a valuation of just 27x; it also pays a dividend yielding 1.62% — higher than the technology sector average of 1.37%.

To sum up, AI companies will continue growing for the foreseeable future, so for investors who wish to lessen the pain of buying at the top, AI dividend stocks are the next best thing. Fortunately for Muslim investors, quite a few of them are Shariah compliant.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.

New to Tayyib Finance? Start with:

A Muslim Investor’s Shortcut to Picking Halal Stocks

The development of Islamic finance over the last couple of decades has brought Muslim investors a lot of convenience. Not only have stocks been assigned Shariah compliance rules, they have also been grouped into Islamic lists by major index providers.