Halal ETFs in Malaysia for Muslim Investors

Diversify out of Western markets with these Islamic exchange-traded funds.

As with most halal ETFs, there are no ‘low-cost’ options here.

But they are still decent diversification picks.

Eq8 Dow Jones Islamic Market Malaysia Titans 25 is one.

For an alternative asset class, consider Trade Plus Shariah Gold Tracker.

Beginner investors are often encouraged to start their investing journeys with exchange traded funds (ETFs). These funds are index-tracking and hence passively managed, which means they can be quite affordable.

The same recommendation applies to Muslim investors. For new investors looking for halal assets, ETFs are an easy way to start. Though, of course, the universe of Shariah compliant ETFs is much smaller, and they also cost more.

Most online resources covering halal ETFs list funds domiciled in Western jurisdictions like the US, the UK and Canada. While an obvious first choice for investors based there, for those seeking diversification, other options elsewhere are available.

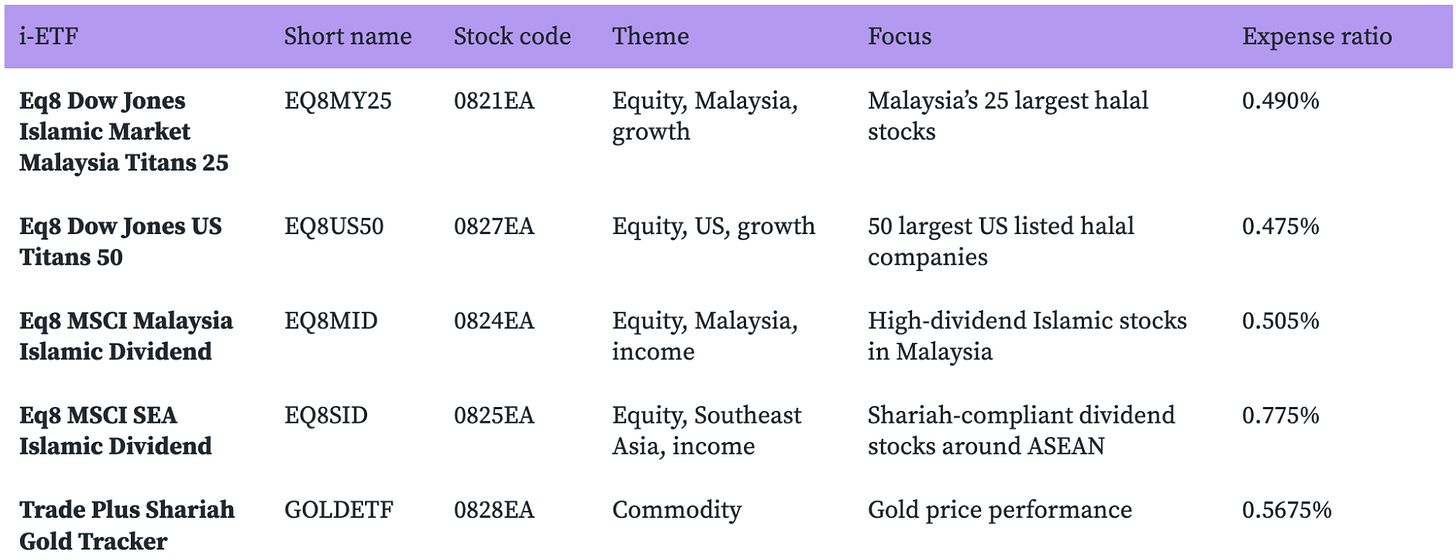

The biggest market for Islamic ETFs outside of the developed world is Malaysia, one of the strongest economies in Southeast Asia and the foremost hub for Islamic finance. There are currently five ETFs (four equity, one gold) listed on the main market of Bursa Malaysia that have been certified as Shariah-compliant.

Halal ETFs listed on Bursa Malaysia

Four of the five halal ETFs in Malaysia are passive index funds managed by Eq8 Capital (formerly i-VCAP Management, the funds prefixed by ‘MyETF’ previously).

i-ETF no. 1: Eq8 Dow Jones Islamic Market Malaysia Titans 25

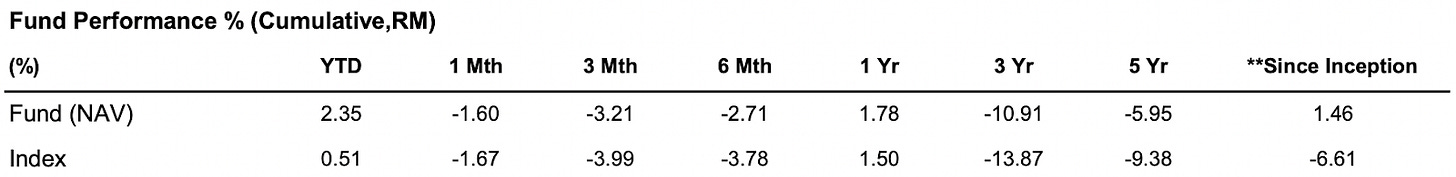

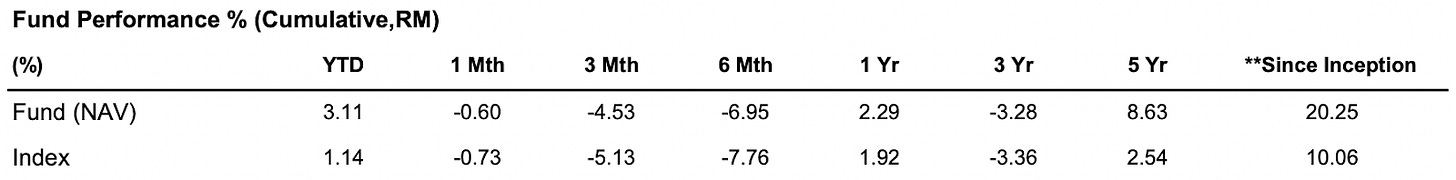

EQ8MY25 tracks the Dow Jones Islamic Market Malaysia Titans 25 Index that comprises the top blue chips across key industries in Malaysia including telecommunications, industrials, healthcare and consumer products.

Listed in 2008, it was Asia’s very first Shariah-compliant ETF. Although returns in most periods since were negative, the fund has consistently outperformed the index.

i-ETF no. 2: Eq8 Dow Jones US Titans 50

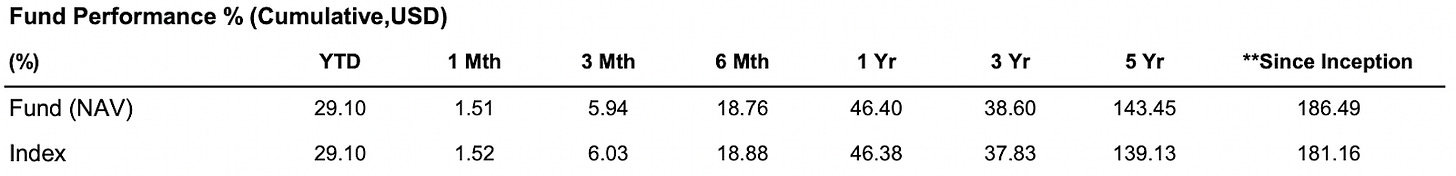

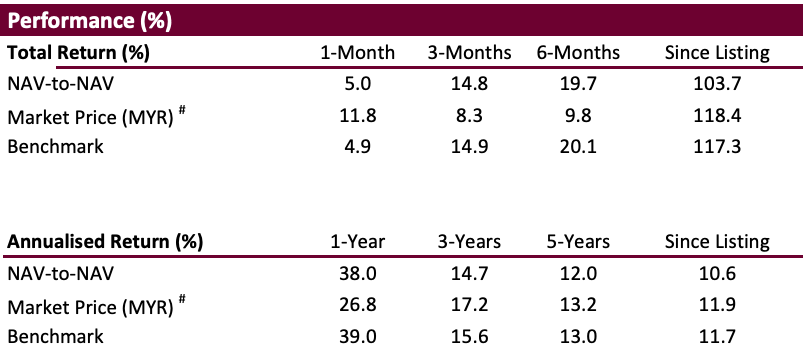

EQ8US50 is based on the Dow Jones Islamic Market US Titans 50 Index. The ETF is heavily tech-focused (68%) with top ten holdings, the biggest tech firms in the US led by Nvidia, Apple, Microsoft, Amazon and Meta, contributing close to 60%.

As the latest launched fund, EQ8US50 has performed the best so far with a cumulative return of 186%.

i-ETF no. 3: Eq8 MSCI Malaysia Islamic Dividend

EQ8MID claims to be the world's first thematic Shariah-compliant ETF. It reflects the performance of Malaysian equities paying above-average dividends. The fund is skewed towards native industries such as plantation, mineral products and petrochemicals.

The dividend yield has been low throughout, hovering around 2%. More alarmingly, no dividend has been distributed in the past two years.

i-ETF no. 4: Eq8 MSCI SEA Islamic Dividend

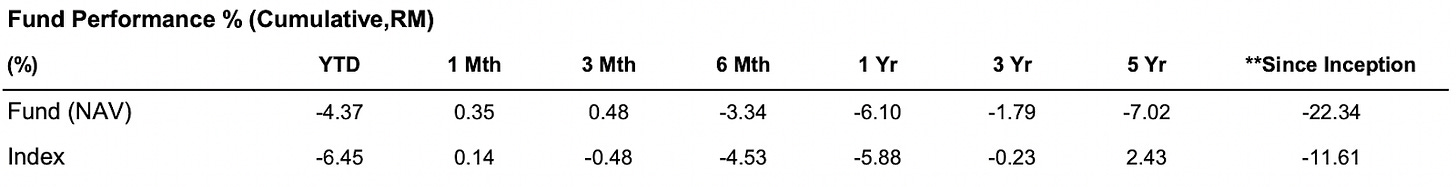

EQ8SID consists of halal dividend-paying stocks around Southeast Asia, or ASEAN (as the regional bloc is known). Malaysia is the top country by allocation of funds (33%), followed closely by Thailand and Indonesia; Singapore and the Philippines hold 8% each.

EQ8SID is the priciest of the lot with a management fee of almost 0.8%. Ironically, it also boasts the worst performance, markedly underperforming the underlying index.

i-ETF no. 5: Trade Plus Shariah Gold Tracker

The last ETF, TradePlus Shariah Gold Tracker, by AHAM Asset Management is the first commodity based Islamic ETF listed in Malaysia. It tracks the price of gold (benchmarked by the LBMA Gold Price) in which at least 95% of the fund’s net asset value must be invested at any one time.

Since the fund is fully backed by physical gold, investors are allowed to exchange their units for gold bars upon meeting minimum unit size requirements.

What Malaysian Islamic ETF should you invest in?

Mostly it depends on your investment goals and/or risk profile as well as your selection criteria for a fund in terms of asset class (equity vs. gold as in this case), market focus (US/other developed markets vs. Malaysia/other emerging markets) and theme (growth vs. income, large cap vs. small cap, etc.).

If you are conservative and seek to minimise risk, your options are income-focused Eq8 MSCI Malaysia Islamic Dividend ETF and Eq8 MSCI SEA Islamic Dividend ETF. But tread cautiously with these two since the former has not been paying dividends lately and the latter is an expensive fund with abysmal performance.

If, on the other hand, you can tolerate more aggressive investing, growth-focused Eq8 Dow Jones Islamic Market Malaysia Titans 25 ETF and Eq8 Dow Jones US Titans 50 ETF would suit you better. Their returns differ vastly but then EQ8MY25 predates EQ8US50 by an entire decade.

Finally, Trade Plus Shariah Gold Tracker ETF is suitable for Muslim investors who would like to diversify away from equities. Gold, as a safe-haven asset, tends to hold up during times of financial or economic turbulence. And gold ETFs are more accessible to small-scale investors than physical gold which entails significant capital and storage outlays.

How do you invest in halal Malaysian ETFs from abroad?

From this year on, foreign investors can use the services of Interactive Brokers (not a sponsored endorsement) to buy stocks and ETFs listed on Bursa Malaysia. The account opening process is fully online and can be completed from anywhere in the world.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock or fund at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.

For more halal investing opportunities from Malaysia, check out:

Investing in Malaysian REITs for Halal Income

Malaysia probably presents the most options for Muslim investors. Over 60% of its capital market is Shariah compliant. That includes real estate investment trusts, or REITs: out of 19 listed on the Main Market of Bursa Malaysia, five REITs have been certified halal.