Halal Stock of the Month: Activision Blizzard

Tayyib Finance introduces the best performing halal stocks that are also sustainable, empowering Muslims to invest responsibly.

The proposed takeover of Activision Blizzard by Microsoft has been all over the news lately. The deal was just approved in the EU but had been earlier blocked by the UK regulatory authority. Although analysts are divided on the prospects of this deal, the target company is a quality Buy candidate on its own — and for Muslim investors too.

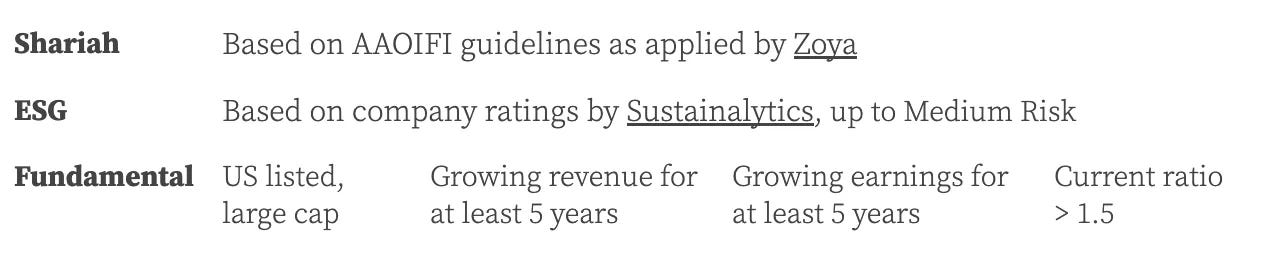

Interlude: The selection criteria

All stocks I cover fulfil the same basic criteria, in two areas. First, Shariah prescriptions which automatically eliminate companies in haram industries and those that exceed the stipulated debt or interest thresholds. To be tayyib, the remaining businesses also need to clear minimum environmental, social and governance (ESG) standards: at the very least, they shouldn’t profit from anything that is clearly damaging to the planet or its inhabitants. The other aspect is financial performance; I stick with the fundamentals to narrow down to businesses with a record of stable and reliable growth.

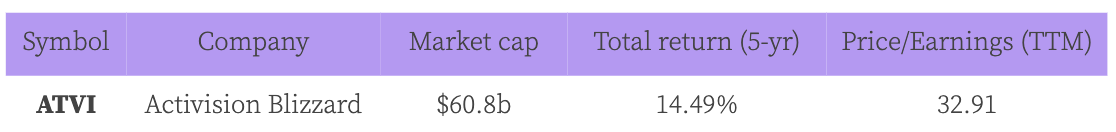

Activision Blizzard (NASDAQ: ATVI)

Revenue (compounded 3-year average growth): 8.07%

Diluted earnings per share (compounded 3-year average growth): 5.18%

Median earnings growth forecast for 2023: 15.83% per year

Headquartered in California, Activision Blizzard develops gaming content for video consoles, PCs and mobile devices. It generates income through full-game and in-game sales, subscription services as well as licensing to third-party distributors. Its flagship products are franchises like Call of Duty, World of Warcraft, Diablo, Hearthstone, Overwatch, Overwatch League, and Candy Crush.

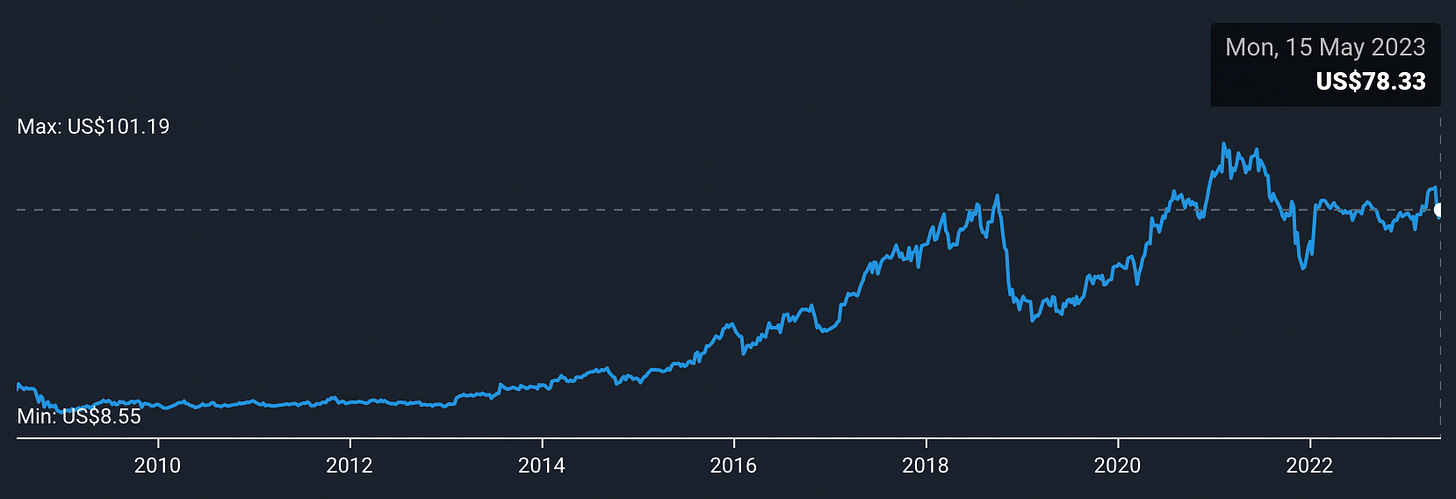

Financially, ATVI has high quality earnings (given a historical growth rate of 15% a year) and a flawless balance sheet (with abundant cash and low leverage). The bottom line is widely expected to continue expanding in double-digits — even without Microsoft in the picture. Most recently, the company has exceeded expectations with strong Quarter 1 results.

The stock is currently trading at $77 per share, while the average target price for the next 12 months comes to about $91.

Takeaway

Gaming is being touted as the next big change in entertainment. There has been a marked shift in consumer preference from 2D to interactive 3D experiences. And Activision Blizzard, with a commanding stable of intellectual property, is leading the charge. The shares, to be sure, are not cheap. But that is to be expected from a quality business delivering high growth in an exciting industry. ATVI, therefore, is definitely worth considering for Muslim investors looking for a halal gaming stock.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.

Update: Microsoft, the owner of Activision Blizzard, is now an official BDS target. Boycott and divest.

https://www.dropsitenews.com/p/bds-calls-for-boycott-of-microsoft

Thank you for this article)) very informative and important for us))