Halal Income Pick: Frasers Logistics & Commercial Trust

The undervalued Singaporean REIT is a sturdy tayyib investment with a good dividend.

This post takes a closer look at an investment that topped my shortlist of sustainable halal dividend stocks in Singapore covered last month.

As a mature market, Singapore is home to ample high quality investments. Real estate investment trusts (REITs) among them are particularly popular.

Muslim investors have a few options to choose from. The most interesting to me at this time is Frasers Logistics & Commercial Trust (FLCT), a blue chip sponsored by a multinational with a panoply of real estate assets across classes and continents.

One of several under Frasers Property, FLCT manages industrial logistics and commercial assets, over one hundred of them strewn across developed economies of Australia, Germany, the United Kingdom, Singapore and the Netherlands, worth almost $7b.

High quality source of halal income in Asia

Like a number of other Singaporean REITs, FLCT boasts a strong balance sheet. Unlike many others though, it also has a low leverage ratio, at 28.6% as of mid-June, and consequently lower debt repayment obligations — a huge plus in the current environment of persistently elevated interest rates.

Despite macro headwinds, the REIT has been growing its rental revenue, mostly in the logistics sector in Australia and Germany. Between April and June this year, rental reversions averaged 21.4%. And the management continues to guide positively, citing a possible flight to quality.

Healthy cash flow means FLCT has been able to exploit inogranic growth opportunities. In 2022, it acquired properties, mostly of industrial and logistics kind, costing $342m (including forward funding deals). Since IPO in 2016, accretive acquisitions totalled about $3.5b.

Its entire logistics portfolio is fully occupied, while commercial portfolio is at 90% occupancy. Lease terms are in the range of 3-7 years, and expiries are proactively dealt with. Tenant and industry concentration risks are low, although there is a notable exposure to foreign exchange volatility.

There is only one Singaporean tenant, Google Asia Pacific — though it single-handedly brings 10% of portfolio value — but this contract ends in February 2024. Australian properties make the majority with 51%, followed by Germany (24%).

Another premium for FLCT comes from its excellent sustainability marks. Its industrial portfolio has earned the highest rating by the Green Building Council of Australia. Additionally, the REIT ranks 5-star based on GRESB, an ESG benchmark for real assets, and ‘AA’ based on MSCI ESG Ratings.

Takeaway

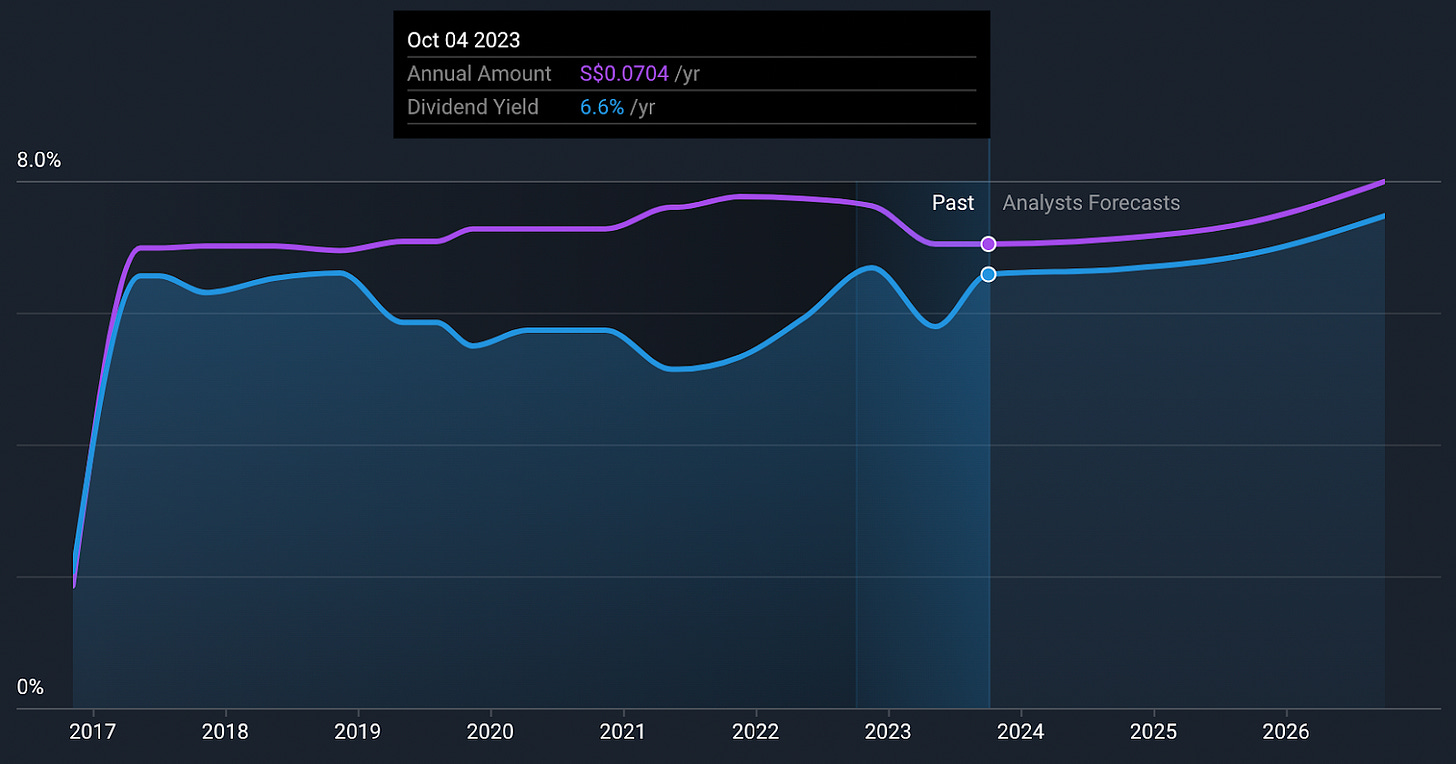

FLCT is a resilient REIT led by a capable sponsor. For retail investors, a REIT such as this — one that grows revenue and value reliably in any operating environment — can be a natural hedge against inflation. For Muslim income investors, FLCT should be a prime pick, with a yield in the top quartile of dividend payers in the Singapore market.

And it is affordable too. Valued at a historically low 7.1x price-to-earnings, FLCT is one of the cheapest S-REITs right now; peers tend to trade at high double digits. The market may have been dismissive but the analysts are optimistic. Their 12-month price targets average +25% from the current S$1.07 per share.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.