PDD Holdings: A High-Growth Chinese Stock for Muslim Investors

Good Finance introduces the best performing halal stocks that are also sustainable, empowering Muslims to invest responsibly.

Originally known as Pinduoduo, PDD has reshaped Chinese e-commerce through a concept of social shopping. Following in the footsteps of such Internet giants like Alibaba and JD.com, it has all the makings of China's next big success story. It also happens to be a halal stock. So Muslim investors, take note.

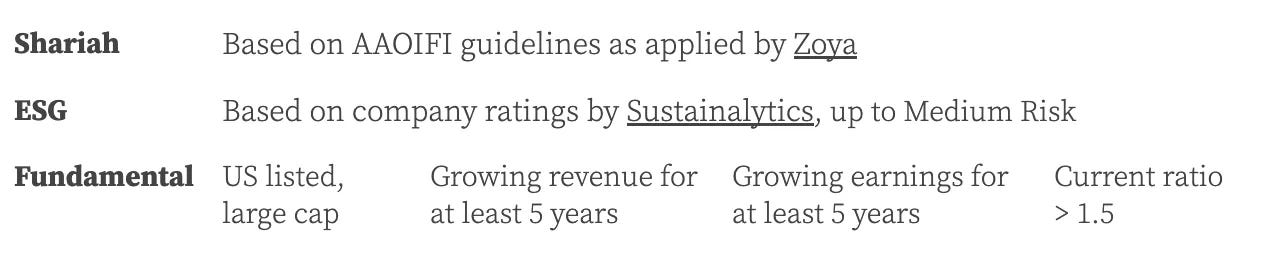

Interlude: The selection criteria

All stocks I cover fulfil the same basic criteria, in two areas. First, Shariah prescriptions which automatically eliminate companies in haram industries and those that exceed the stipulated debt or interest thresholds. To be tayyib, the remaining businesses also need to clear minimum environmental, social and governance (ESG) standards: at the very least, they shouldn’t profit from anything that is clearly damaging to the planet or its inhabitants. The other aspect is financial performance; I stick with the fundamentals to narrow down to businesses with a record of stable and reliable growth.

PDD Holdings Inc. (NASDAQ:PDD)

Revenue (compounded 3-year average growth): 65.01%

Levered free cash flow (compounded 3-year average growth): 100.74%

Diluted earnings per share (year-on-year growth): 183.56%

Median earnings growth forecast: 15.7% per year

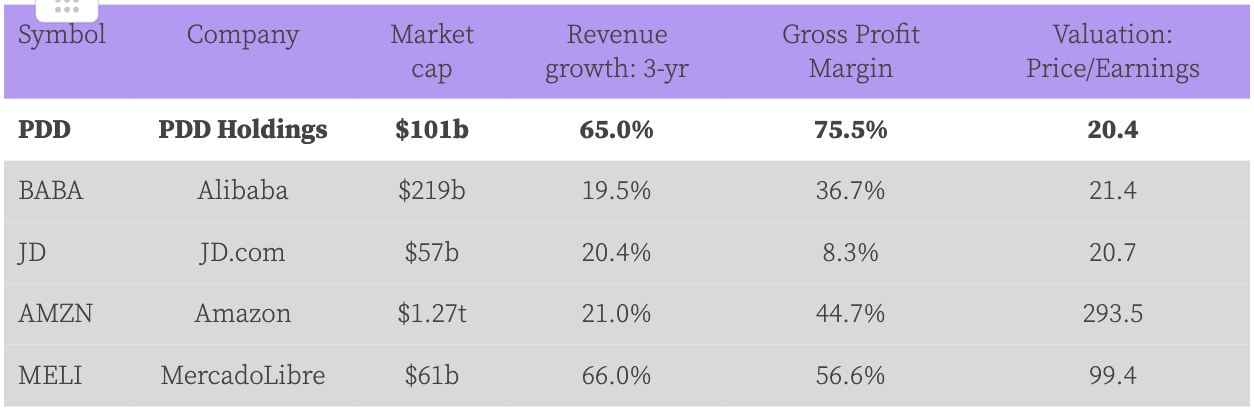

For a high-growth company that it is, PDD is remarkably prudent. Its gross margins come above 75%; net margin is at 25%. Over the past five years, revenue has increased at a rate that is unmatched in the retail industry, 115%. The company became profitable in 2021 and has since grown earnings by 68%. On the balance sheet side, it has a lot of cash and little debt.

Where PDD does splurge is sales and marketing targeting its core customer base — China's smaller cities with price-sensitive markets. It has started expanding globally in earnest just recently with an app called Temu (although it seems to have run into some trouble already).

Thesis

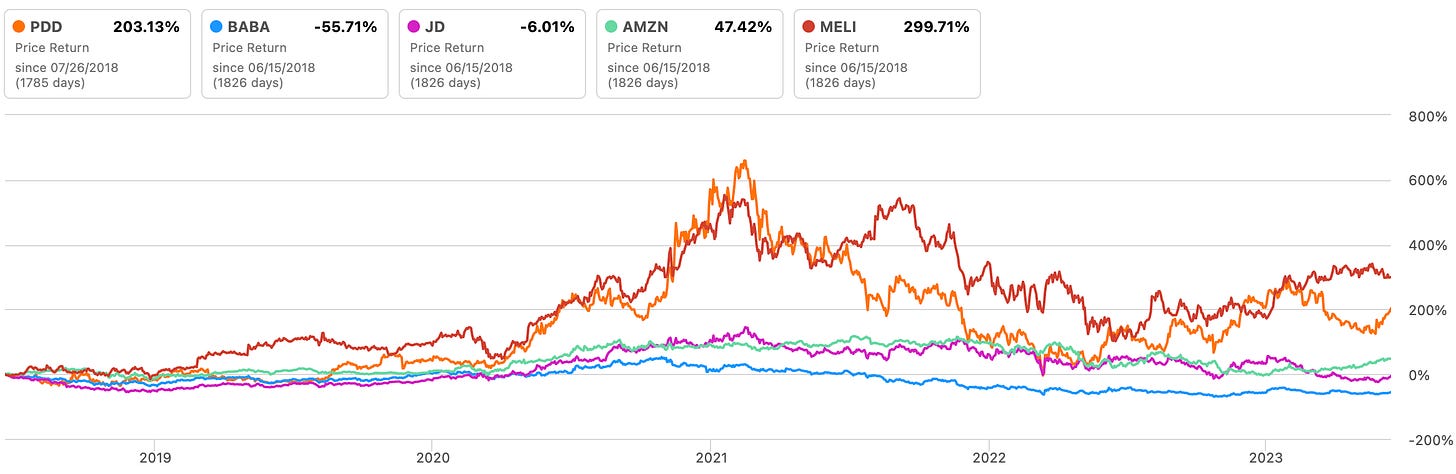

The stock is definitely selling cheap at present given its growth record and potential. Its price-to-earnings ratio is lower than that of peers including the likes of MercadoLibre, another fast-grower in online retail hailing from Latin America.

One apparent reason for the market’s caution about PDD is the perennial conflict between China and the West — and consequent targeting of Chinese companies, especially in tech, by the latter. PDD seems to be aware of this, for it has swiftly taken steps to dissociate the newly launched Temu from its Chinese origins.

Investors though, in large part, do not need to dwell on the China risk too much. Fundamentals of PDD’s business should be the core consideration, and those are unequivocally impressive.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.