Petronas Stocks: Halal but Short of Tayyib

Public holdings of Malaysia’s top corporation make a good addition to a dividend portfolio of Muslim investors.

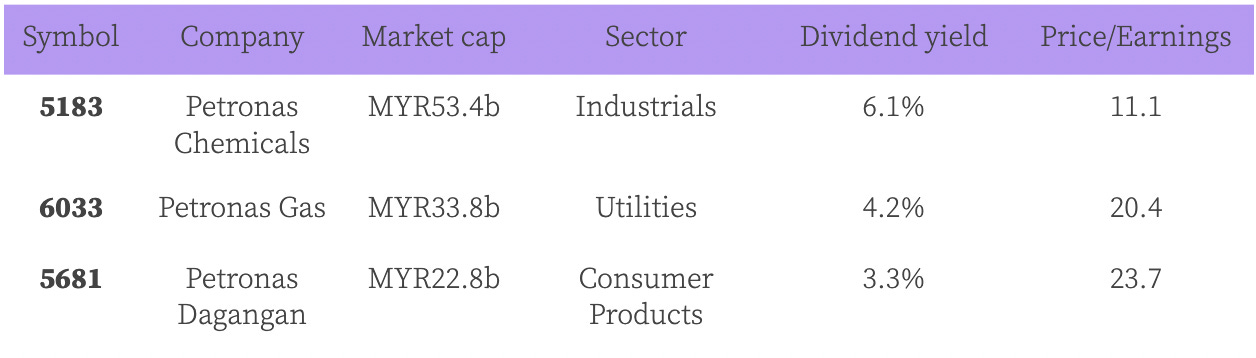

Bursa Malaysia is brimming over with Shariah compliant stocks. Blue chips among them are favoured for their stable performance and reliable returns, dividends included. Petronas, a government-owned oil and gas corporation, owns three like-named publicly listed subsidiaries of this quality: Petronas Chemicals, Petronas Gas and Petronas Dagangan. All three are halal income prospects.

Interlude: The selection criteria

The stocks I cover fulfil the same basic criteria, in two areas. First, Shariah prescriptions which automatically eliminate companies in haram industries and those that exceed the stipulated debt or interest thresholds. To be tayyib, the remaining businesses also need to clear minimum environmental, social and governance (ESG) standards: at the very least, they shouldn’t profit from anything that is clearly damaging to the planet or its inhabitants. The other aspect is financial performance; I stick with the fundamentals to narrow down to businesses with a record of stable and reliable growth.

In this case, the triad of Petronas stocks are indeed halal as verified by the Shariah Advisory Council of the Securities Commission Malaysia. However, their ESG credentials are lacking: as a fossil fuel company, Petronas is not doing enough to change. And the risk scores by Sustainalytics (5183, 6033, 5681) are a tad too high. I thus refrain from calling them tayyib.

Petronas Chemicals (KLSE:5183)

5-year average net profit margin: 21.52%

5-year average return on equity: 13.65%

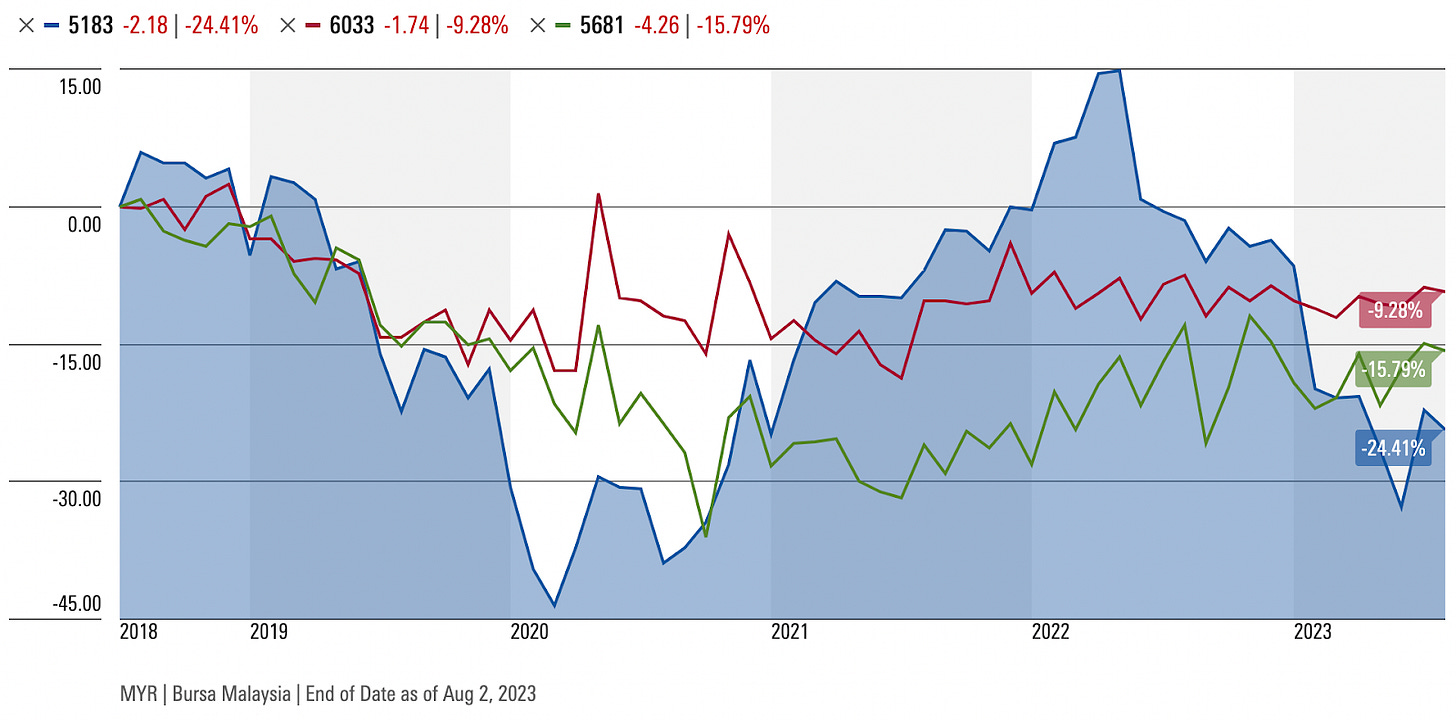

5-year price performance: -24.41%

The largest of the three, Petronas Chemicals produces and sells commercial petrochemicals and their derivatives. The top name in the local industry, the company is also a major exporter to China and Southeast Asia.

Petronas Gas (KLSE:6033)

5-year average net profit margin: 34.85%

5-year average return on equity: 14.43%

5-year price performance: -9.28%

Petronas Gas is a gas infrastructure and utilities company. Its processing plants and transmission pipelines are centrepoints for treatment and transportation of gas from offshore fields off the east coast of Malaysia.

Petronas Dagangan (KLSE:5681)

5-year average net profit margin: 2.32%

5-year average return on equity: 11.23%

5-year price performance: -15.79%

Petronas Dagangan operates the widest network of petrol stations throughout Malaysia. Notice that this particular subsidiary generates the lowest net profit margins, probably because of its mostly retail focus.

Thesis: Halal Income Opportunity

Of the three halal counters, Petronas Chemicals has the lowest valuation and the highest upside potential, with analyst price targets averaging 26.6%. But it is also the stock that has seen the most volatility in the past several years. Petronas Gas and Petronas Dagangan, in contrast, are expected to move in much smaller increments, +5.4% and -4.7% respectively.

Price performance, however, is not the main point here. All of them are consistent Shariah compliant dividend payers with the record of increasing payouts over the last decade. Petronas Chemicals, in particular, at a yield of 6.1% is currently in the top quarter of the Malaysian market, although near-term challenges may bring the payments down to a lower pre-Covid median.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.