Halal Stocks? Buy Nike or Lululemon

Tayyib Finance introduces the best performing halal stocks that are also sustainable, empowering Muslims to invest responsibly.

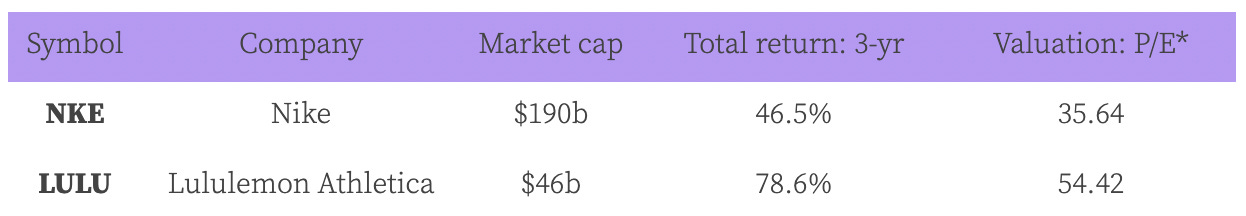

Nike and Lululemon are a bit of an unusual pairing but the two have more in common than it appears. The former is often categorised as a footwear company although a third of its sales comes from apparel. The latter, known for its athletic wear, is now in the footwear business too (which specialists like Nike aren't too happy about). For Muslim investors, both are good picks as halal and all-round tayyib stocks.

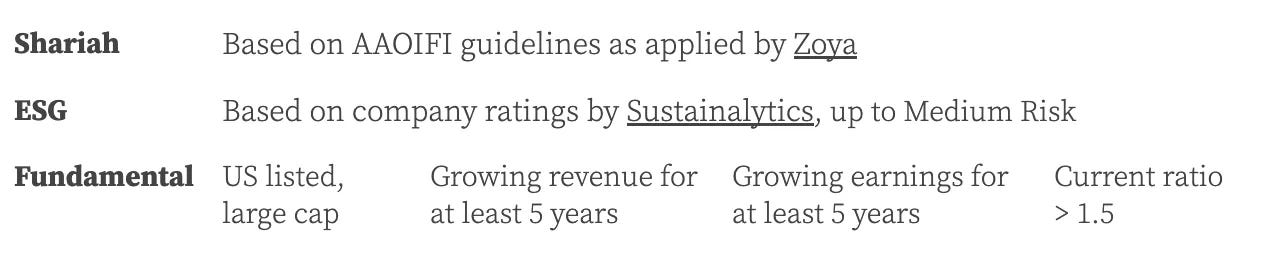

Interlude: The selection criteria

All stocks I cover fulfil the same basic criteria, in two areas. First, Shariah prescriptions which automatically eliminate companies in haram industries and those that exceed the stipulated debt or interest thresholds. To be tayyib, the remaining businesses also need to clear minimum environmental, social and governance (ESG) standards: at the very least, they shouldn’t profit from anything that is clearly damaging to the planet or its inhabitants. The other aspect is financial performance; I stick with the fundamentals to narrow down to businesses with a record of stable and reliable growth.

Nike (NYSE: NKE)

Revenue (compounded 3-year average growth): 7.0%

Diluted earnings per share (compounded 3-year average growth): 8.6%

Median earnings growth forecast: 4.4% per year

Dividend growth (compounded 3-year average growth): 11.5%

Dividend yield (forward): 1.10%

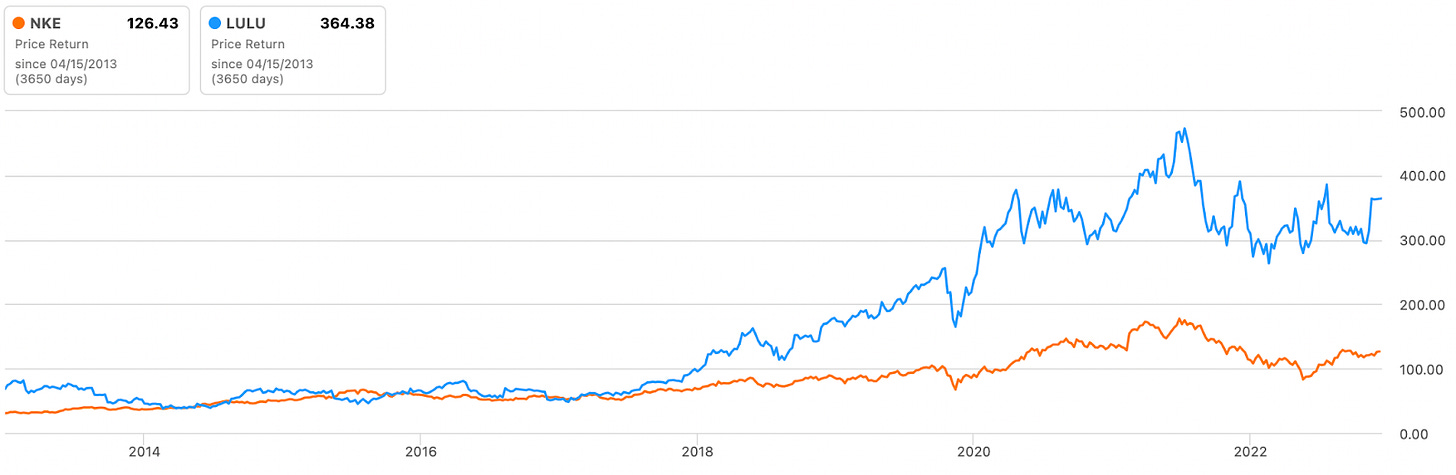

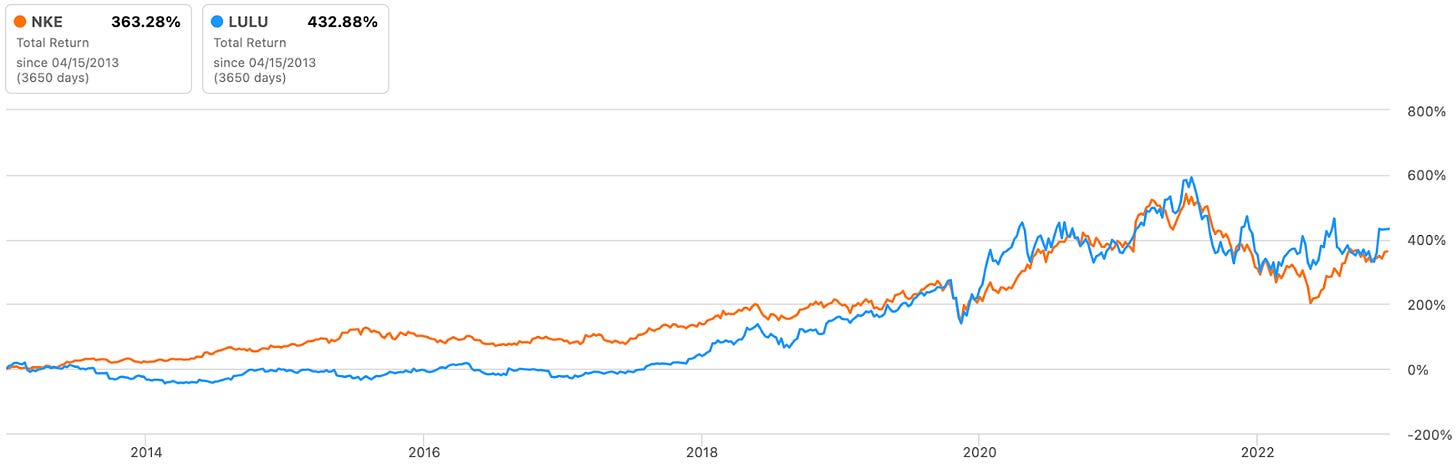

Nike needs no introduction. Its global renown is unrivalled, and yet it is still growing at a fairly decent clip, revenue and profit expanding in high single digits. Recently growth has been particularly strong in Greater China which offsets the weaker domestic market in the US. Well endowed with cash, the company is also a consistent dividend payer, with a track record of increasing payouts every year for more than a decade now.

Lululemon Athletica (NASDAQ: LULU)

Revenue (compounded 3-year average growth): 26.8%

Diluted earnings per share (compounded 3-year average growth): 10.7%

Median earnings growth forecast: 19.6% per year

Lululemon is a much younger player whose top and bottom lines have been growing more energetically — over 10x in the last two decades. The brand is a big hit with women, and more men (the huge untapped market) are being converted. A high growth story, the company is nonetheless extremely profitable: its gross profit margin for the last 12 months averaged 55% against Nike’s 44%, mainly due to the dominance of the direct-to-consumer model at Lululemon.

Takeaway

As one would expect, valuation wise, at 54 trailing earnings Lululemon is trading at a big premium to Nike that is selling at 35. Which you choose is primarily a matter of your investing style. Nike with a strong established base in economically healthier developing markets is a good buy for more conservative Muslim investors who would appreciate reliable dividend checks. However, the company has had issues with inventory and cash collection. Lululemon, on the other hand, is a more definite halal buy for growth investors. It has managed to steer clear of similar supply chain problems maintaining margins and growth momentum. It is worth noting though that its current valuation is slightly above the historical average (five-year 54.95).

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.