A Muslim Investor’s Shortcut to Picking Halal Stocks

Islamic equity indices provide a ready pool of Shariah compliant stocks to choose from.

The development of Islamic finance over the last couple of decades has brought Muslim investors a lot of convenience. Not only have stocks been assigned Shariah compliance rules, they have also been grouped into Islamic lists by major index providers.

Parsing through these Shariah compliant indices — as well as funds tracking them — is probably the easiest way to start one’s search for halal stocks.

Indices as a source of inspiration in Islamic investing

Islamic equity indices are usually derived from their original conventional counterparts by applying the additional rulings set by the Shariah. The resulting lists, therefore, are shorter.

Also note that full lists of companies comprising Shariah indices are not publicly accessible; available though are the top ten holdings as seen in factsheets which are updated on a quarterly basis.

Despite the limitations, the multitude of geographical locations and investment themes make indices a treasure trove of ideas.

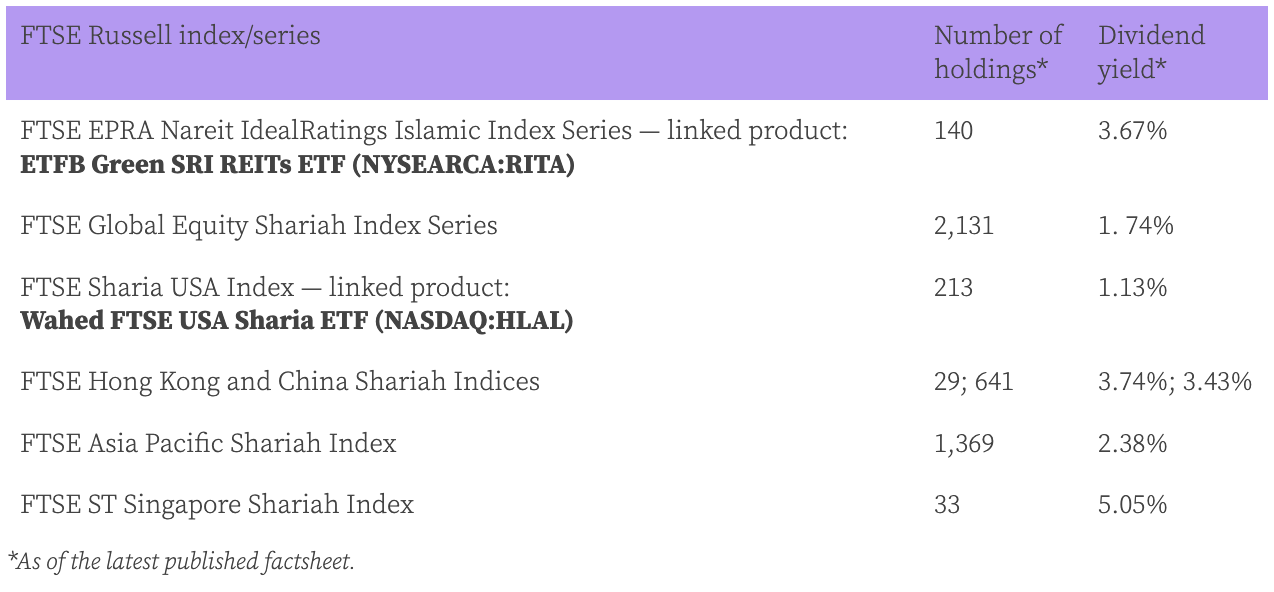

FTSE Russell, for instance, has a total of 38 different Shariah screened indices, most covering different geographies but also sectors such as infrastructure and themes such as responsible investing. Here are just a few, along with their linked products where available for direct investing.

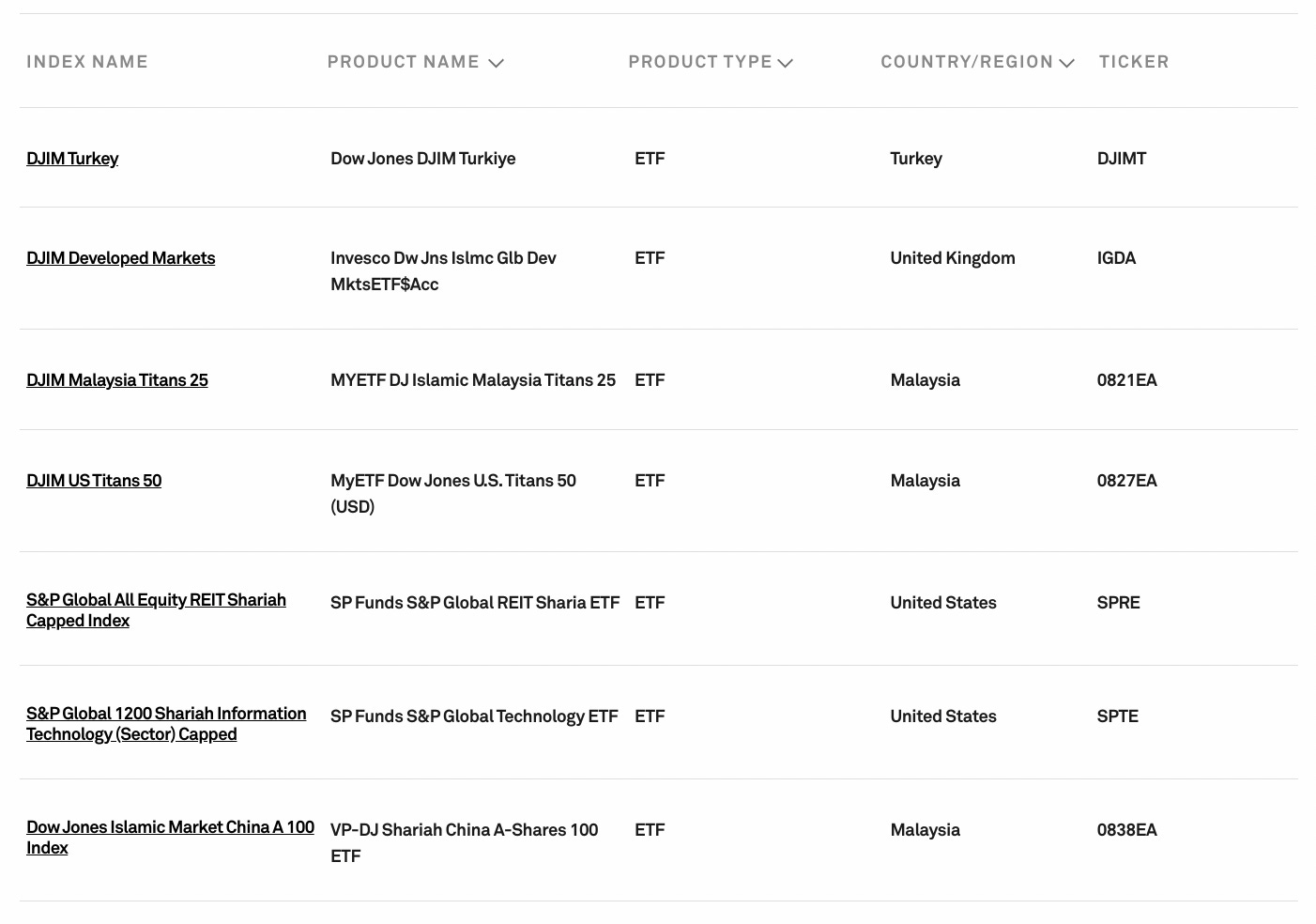

Other prominent index providers, like S&P Dow Jones and MSCI, have Islamic series too. S&P Dow Jones, in fact, boasts the biggest selection with more than 300 indices within two main series — S&P Shariah and DJ Islamic Market — which offer a wide sector coverage and numerous variations in terms of market cap, location and risk.

Halal index-linked products for Muslim investors

The products linked to these indices, exchange-traded funds and mutual funds, are not many but a sufficient number for an average retail investor.

The SP Funds S&P 500 Sharia Industry Exclusions ETF (NYSEARCA:SPUS), for example, is based on the S&P 500 Shariah Industry Exclusions Index.

Another fund by the same company is the SP Funds S&P Global REIT Sharia ETF (NYSEARCA:SPRE) linked to the S&P Global All Equity REIT Shariah Capped Index.

Not included in the table below is the Wahed Dow Jones Islamic World ETF (NASDAQ:UMMA) which tracks the DJIM International Titans 100 Index.

Thankfully for investors, funds do normally publish their holdings in entirety, unlike indices. So even if you do not buy into the funds, you are able to peruse their lists to make your own shortlist of halal stocks, whatever your criteria. The ETFB Green SRI REITs ETF (NYSEARCA:RITA), for one, shows every single one of its 51 holdings, all of which are dividend paying stocks since the fund follows a real estate investment trust focused index. The ETF currently has a distribution yield of 3.43%.

Takeaway

Because halal stocks must fulfil some extra requirements, ideally both Shariah and responsible investing kind, it is easy for Muslim investors to get overwhelmed. By doing the job of basic screening for them, Islamic indices provide a welcome relief. Just ten holdings disclosed by each of the few hundred Islamic indices out there makes a repository of stocks big enough even for the most prolific investors.

If dividend income is what you are looking for, check out this post next:

Tayyib 20: High-Yielding Halal Income Stocks

There is no shortage of advice out there on how to invest for income. Dividend stocks are an easy starting point. But with extra requirements to satisfy, such as those of Shariah compliance and sustainability, things start to get much trickier. With this in mind, Tayyib Finance presents its first installation of high-yielding halal dividend stocks repre…