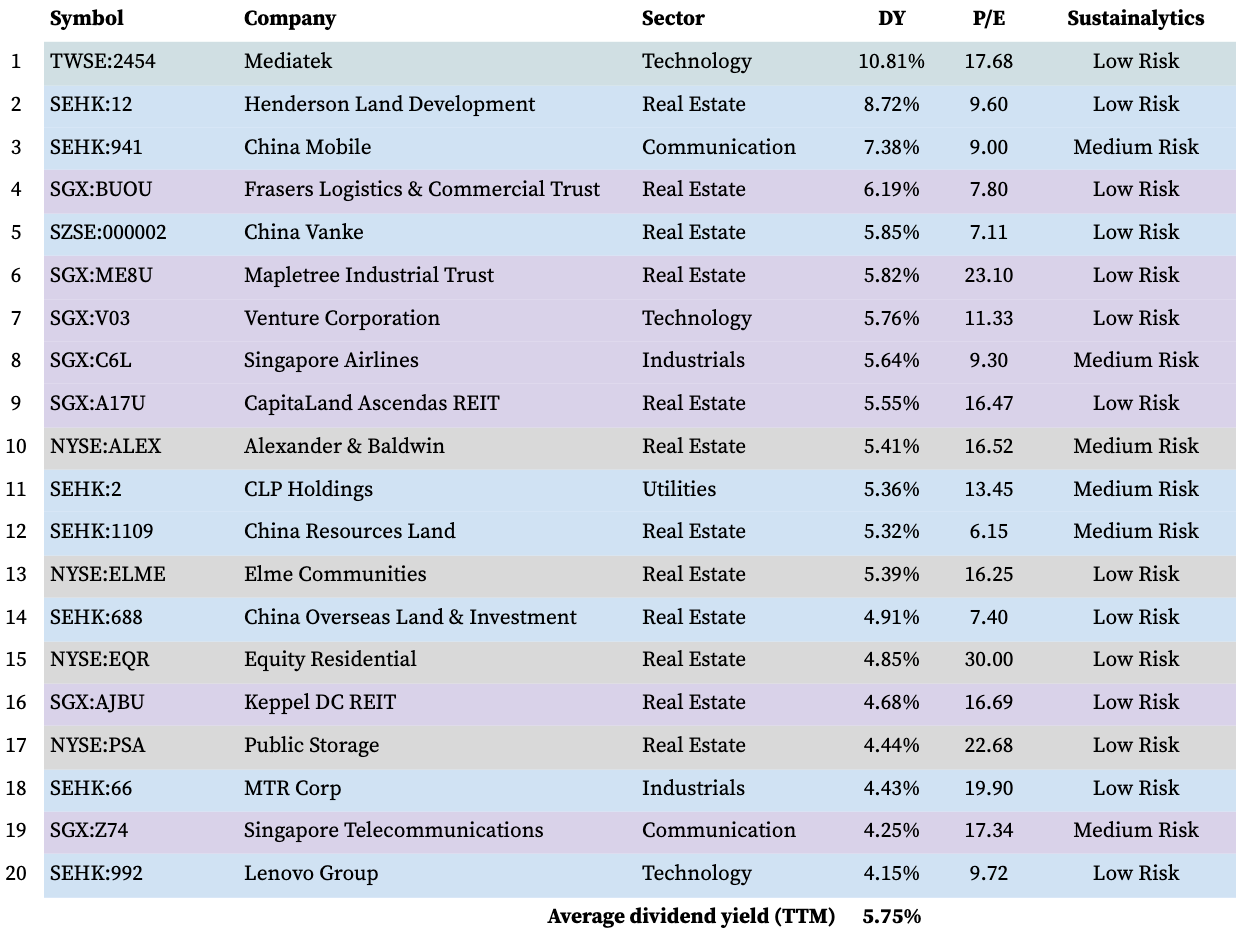

Tayyib 20: High-Yielding Halal Income Stocks

A ready list of sustainable halal dividend stocks to get Muslim investors started.

There is no shortage of advice out there on how to invest for income. Dividend stocks are an easy starting point. But with extra requirements to satisfy, such as those of Shariah compliance and sustainability, things start to get much trickier. With this in mind, Tayyib Finance presents its first installation of high-yielding halal dividend stocks representing ESG-friendly firms to help Muslim investors expand their horizons with new names and ideas.

High-Yielding Halal Income Stocks

Criteria

The list is made up of stocks that fulfil multiple criteria — as simultaneously Shariah compliant and sustainable (or tayyib) and also high-yielding — so the selection process took place in three consecutive stages.

Step 1. The first order of business was to compile a pool of dividend paying stocks from Islamic equity indices focused on Singapore, Greater China and the US since these markets make it comparatively easy for foreign investors to trade shares on.

Singapore: FTSE ST Singapore Shariah Index;

Greater China: FTSE China and Hong Kong Shariah Indices, Dow Jones Islamic Market Greater China Index;

US: FTSE EPRA Nareit IdealRatings Developed REITs Islamic Green Capped Index.

Step 2. From the resulting lot of halal dividend stocks, only those with more than 4% in trailing 12 months dividend yield were selected. It is an arbitrary number but generally a return of 4% and more is considered good in most places, especially given the additional layers of Shariah compliance and sustainability (both of which narrow down the choices significantly).

Valuation wise, disregarding sector specific differences in pricing, the price-to-earnings ratio was capped at 30x, in order to avoid excessively pricey stocks.

Step 3. Finally, in the spirit of Tayyib Finance, the high-yielding halal stocks were assessed on the basis of environmental, social and governance performance, proxied by a rating from Sustainalytics. The selection was limited to companies with Low or Medium Risk at most, referring to the size of unmanaged ESG risk that could potentially affect future financial value.

Results

We have ended up with 9 (Greater) Chinese, 7 Singaporean and 4 US counters, totalling 20 tayyib stocks paying fair dividends.

The highest-yielding with 10.8% is Taiwan’s Mediatek, a semiconductor designer supplying systems on a chip to smartphone makers like Xiaomi and Vivo. Henderson Land Development, a property developer from Hong Kong, is in second place with 8.7%. State-owned China Mobile yielding 7.4% rounds out the top three.

Singaporean stocks that make the list — led by Frasers Logistics & Commercial Trust — average 5.4% in dividend yield. The US stocks, all in Real Estate, yield a lower 5.0%.

Sectors are predominantly Real Estate (for 12 out of 20 stocks) — an expected outcome given the intrinsic Shariah compliance of real estate assets. Technology stocks (3), which tend to be cheaper around Asia than in the US, are next in line. Industrials and Communication Services are two each; to end, there is a single Utility from Hong Kong.

Remarks

Although the selection process has been intricate, the shortlist is not final. It is also fluid given constantly changing prices and varying earnings levels. For this reason, each stock ought to be examined closely for qualities that make for a reliable source of dividend income. (In addition, the halal status of stocks needs to be reconfirmed at least on a quarterly basis.) On our part, we will be covering individual halal income stocks from the above table in the coming posts with more definite recommendations.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.