China Mobile: An Underrated Halal Income Stock

Western investors like to scoff at Chinese companies, state-related ones more so. Their bias is unwarranted which presents an opening for Muslim investors.

The world’s largest wireless carrier, China Mobile makes an unassuming first impression. It may have to do with its ultimate ownership lying with the government of China or, relatedly, its not long-past troubles with the US authorities (which resulted in a forced delisting by the New York Stock Exchange).

No matter, though. Fundamentally, it is a superb business that pays a reliably good dividend — all for a very reasonable price. And fortunately for Muslim investors, it just happens to be Shariah compliant.

Halal income stock: China Mobile (SEHK:941)

Sector: Communication Services

Market cap: HK$1.5t

Return on equity: 10.3%

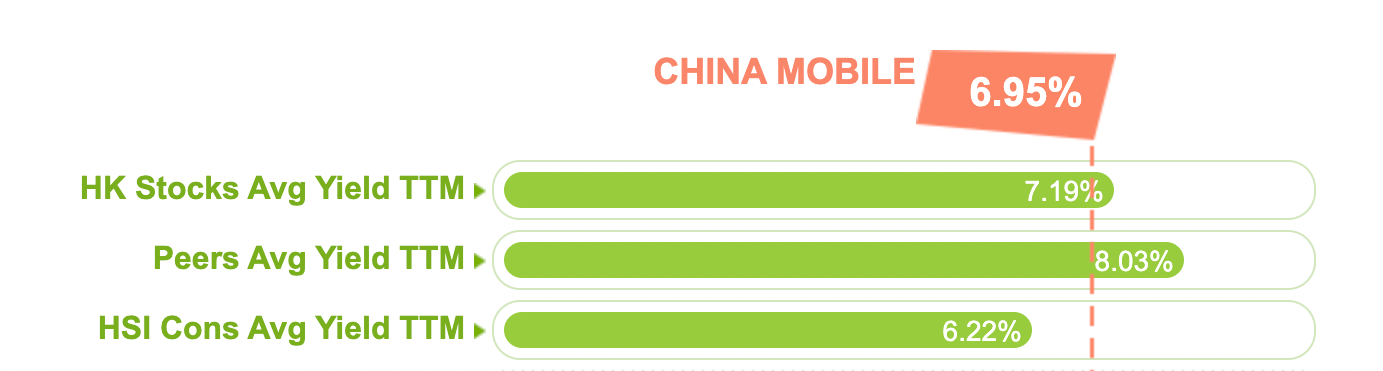

Dividend yield: 6.9%

Price/Earnings ratio: 9.0x

Part of the MSCI China A Onshore Islamic Index, not only is China Mobile the leading mobile service provider globally, but also one of the largest red chips — Chinese state-owned companies listed in Hong Kong.

As of December 2023, it had 991 million mobile customers throughout Mainland China and Hong Kong (plus some international territories), most of them subscribers to 5G plans. It has held the biggest chunk of the domestic market for the longest time, with an especially strong grip over China’s sprawling lower-tier cities (home to over two-thirds of the population) and rural areas.

A Shariah compliant dividend stock that is also tayyib, China Mobile makes for a good halal income investment.

Shariah compliant fundamentals

Although a mature business, China Mobile has been growing both revenue and profit consistently, at average annual rates of 6.8% and 3.7% respectively. For the first three quarters of 2023, China Mobile’s operating revenue came to CN¥775b, of which service revenue made up 85%. Newer business segments — including cloud, big data and IoT smart solutions — are the driving forces behind renewed growth.

Profitability aside, China Mobile is also exceptionally healthy with no debt on its balance sheet and plentiful cash amounting to CN¥358b. The company’s credit rating follows China’s which is currently A1 with a Negative Outlook from Moody’s. Concerns about slowing economic growth and persisting property sector issues have been cited as reasons for the recent downgrade to outlook.

China Mobile’s own prospects, however, look promising, with focus on innovative technologies encouraging the continual expansion of the customer base. 5G and Computing Force Network (CFN) are the core elements of its forward strategy on infrastructure development.

Halal dividend income

Historically robust financial standing can be seen in dividends, which have been increasing for the past ten years, from about 4% then to 6.9% at present. With a 70% payout ratio, there is still room for payments to increase in the future — which is something the management is committed to.

Importantly, the Shariah compliance of China Mobile’s business means that its Muslim shareholders will be receiving a regular halal income.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.

For other halal income stocks, go to Tayyib 20:

Tayyib 20: High-Yielding Halal Income Stocks

There is no shortage of advice out there on how to invest for income. Dividend stocks are an easy starting point. But with extra requirements to satisfy, such as those of Shariah compliance and sustainability, things start to get much trickier. With this in mind, Tayyib Finance presents its first installation of high-yielding halal dividend stocks repre…

Wonder how the Chinese stock market will fare this year? Here's a helpful insight: https://www.youtube.com/watch?v=-uEejtj859c