Halal Automotive Stocks: Why BYD and not Tesla

BYD Company is rising fast in both hybrid and electric vehicle markets and provides halal income for Muslim investors.

The impending cut to US interest rates is on everyone’s mind. Investors in this environment understandably wonder where the markets are heading.

Usually named among sectors that benefit from lower interest rates is the consumer discretionary sector which covers all the non-essentials households buy. As long as economic growth gains adequate traction, falling interest rates reduce borrowing costs, which in turn stimulates spending for discretionary purchases. Like an automobile.

One of the most interesting groups to watch will be automotive stocks, electric vehicle companies among them. The top two globally are America's best-known Tesla and China’s BYD. Both are halal for Muslim investors to own, but one is a better buy.

A different Tesla

Tesla has long been synonymous with electric cars. Brand power, charging network, software and a host of related services, alongside the cult of personality around founder Elon Musk, have propelled the stock over 16,000% since IPO in 2010.

It has not all been smooth sailing for Tesla. Now, with ever more competition in the EV space, from legacy car makers and pure plays alike, growth is slowing. It has been unable to offer cheaper cars for mainstream consumers who are the next big market for EVs. And cutting prices is at best a stopgap measure, hurting profits and cashflow.

Enter BYD. Not only is the Chinese automaker giving Tesla a run for its money when it comes to EV numbers, it also boasts an advanced hybrid platform to which the likes of Toyota are switching. Assembly aside, BYD’s background in manufacturing batteries has been a huge boon, helping it release ever more models at affordable price points. In fact, it probably has the best battery technology out there in Blade.

These are some of the reasons why BYD is the faraway EV leader at home in China. Even more impressively, it outpaced Tesla in the recent past. Their latest Q2 results were again very close: 426,039 electric vehicles sold by BYD versus 443,956 delivered by Tesla.

Mr Musk is worried, and he should be. (His advocacy of high tariffs saw the US import taxes on Chinese EVs increasing to a whopping 100%.) BYD is unchallengeable price wise and is winning market share everywhere, sparing no expense setting up in new locations (and it can afford to do so). Europe, where tariffs have been hiked as well, remains the primary target; also in focus are emerging markets where electric cars are still more of a novelty.

BYD upping the ante

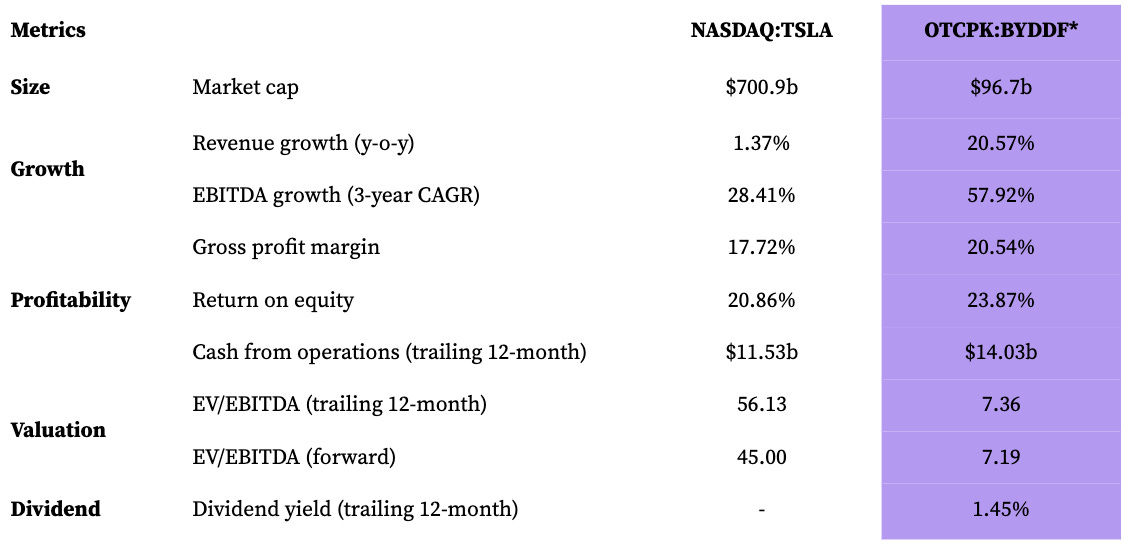

Financially, BYD is overtaking Tesla in almost every metric. Growth, obviously, has been higher and cash flow generation too. But as of late profitability has improved markedly, with BYD’s gross profit and EBITDA margins coming in above Tesla’s.

Despite BYD’s growing dominance, its shares are still majorly undervalued compared to Tesla’s. And most of the latter’s outlandish value seems to be coming from the robotaxi business it is branching out to. So in terms of EVs for the mass market outside of the US, BYD will hardly be contested.

Halal dividend stock of your dreams

BYD, like other mainland stocks, has been suffering from the Chinese discount, hence the negative returns in the last few years. Fundamentally though, the automaker is as robust as can be and has the most potential to lead the EV car space on a global scale.

A forerunner in EVs and hybrids (including plug-in hybrids), it has the best of both worlds: it can keep growing briskly by selling to the large pool of ready buyers that has formed for hybrids, while simultaneously building out the nascent electric vehicle markets.

It is worth noting that BYD pays a dividend. It is small at 1.4% but given the growth trajectory and a current payout ratio of only 28%, it is reasonable to expect that future payments will move upward.

All in all, while far less hyped of an investment than Tesla, BYD would be a more grounded choice for Muslim investors who are looking to partake in the automotive future.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.

Do you know what other stocks are anticipated to do well in a low-interest rate climate? Tech stocks is one category.

Halal AI Stocks That Also Pay Dividends

Generative artificial intelligence has been all the rage recently. That has not been lost on the investing world. While a few of the large AI stocks are not Shariah compliant (or questionable) — like Microsoft, Alphabet, Meta and IBM — plenty are halal, which allows Muslim investors to ride the trend as well.

Some insights into Tesla's robotaxi business and its competitors in this area: https://simplywall.st/article/competition-is-heating-up-for-tesla-in-the-robotaxi-market