Invest in MediaTek for Halal Income

A closer look at the highest-yielding semiconductor firm on Tayyib Finance’s list of halal dividend stocks.

Taiwan’s big claim for fame is semiconductors. The latter, in turn, are synonymous with TMSC, Taiwan Semiconductor Manufacturing Company, the world’s largest foundry. But Hsinchu, where TMSC is headquartered, is also home to another notable Taiwanese firm.

Halal income stock: MediaTek Inc.

Market cap: NT$1.5t (US$47.8b)

Total assets: NT$618b (FY2022)

Growth rate: EPS 19% (annualised)

Dividend yield: 8.3%

Price/earnings: 20.8x

Although nowhere near the age and size of its Taiwanese big brother, MediaTek has made a name for itself as an innovative chip designer. Its integrated circuits power close to two billion devices a year, making MediaTek the fifth largest fabless company globally. It competes with AMD (which acquired local peer Xilinx in 2022) in Taiwan and with Qualcomm, Broadcom and Nvidia in the US.

MediaTek’s chips are found in smartphones, Chromebooks, smart home devices, IoT tech and voice assistants. Its systems on a chip (SoCs) for mobile devices have been performing particularly strongly; latest editions are flagship Dimensity 9300 and Dimensity 8300 for 5G smartphones.

A Shariah compliant dividend stock that is also tayyib, MediaTek Inc. makes for a good halal income investment.

Shariah compliant fundamentals

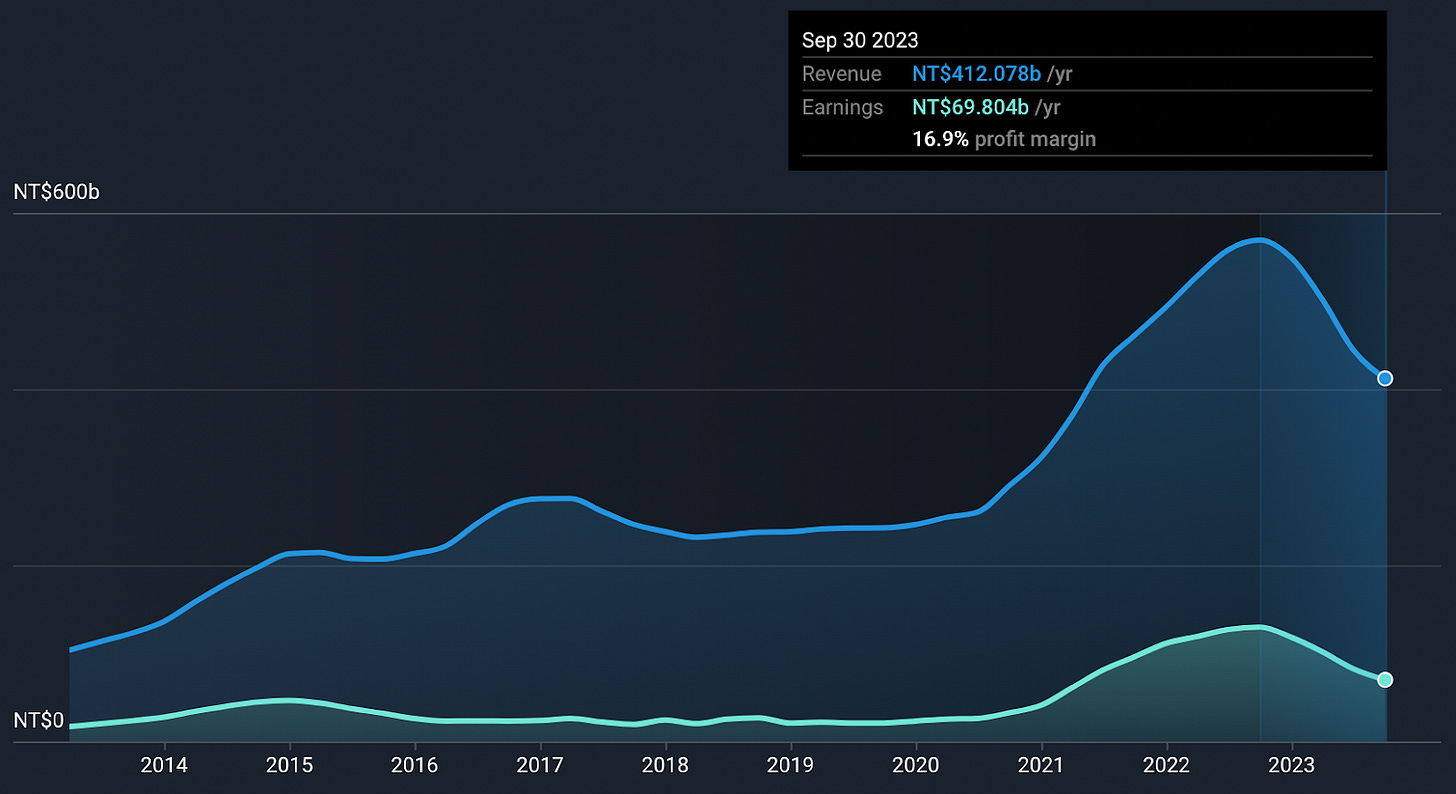

MediaTek boasts quality earnings which have been growing at double-digit rates, 19% on average over the past three years (and 34% in the last five years). Growth has moderated in 2023 in tandem with an overall downturn in the semiconductor industry, but return on equity is still high at nearly 18%.

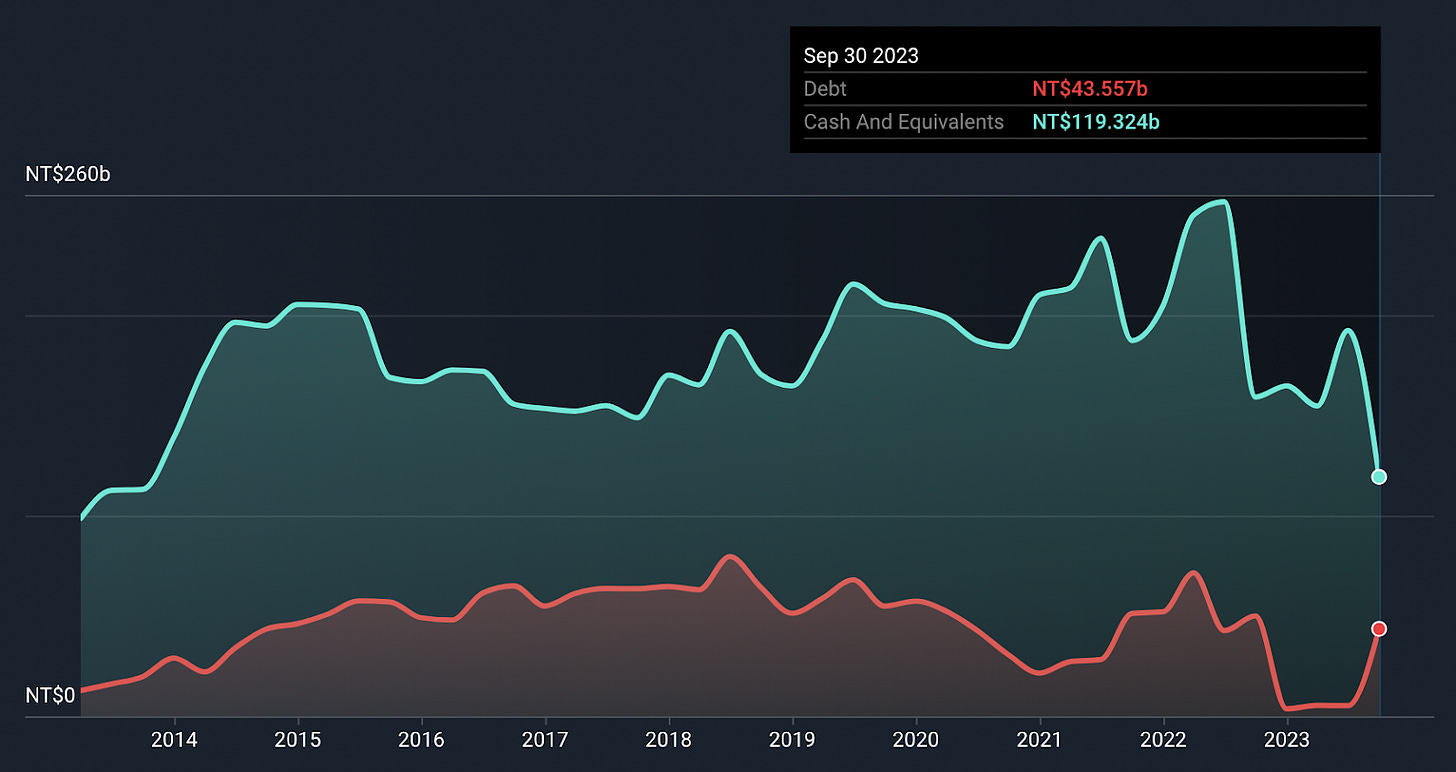

The company’s balance sheet is sturdy, with low debt levels and plentiful cash and cash flow from operations. Debt-to-equity has reduced from 23% to 11% over the past five years; operating cash flow to debt ratio exceeds 200%.

Halal dividend income

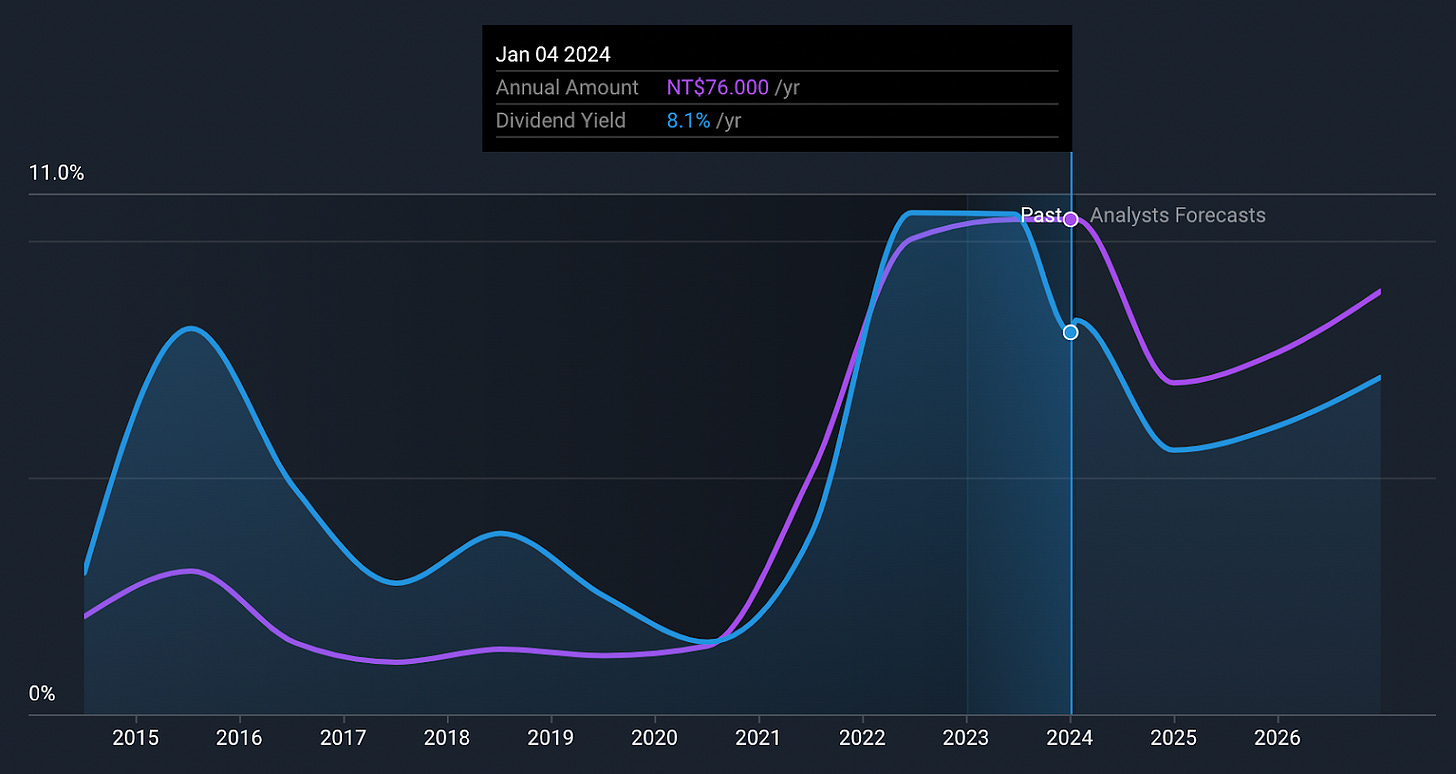

MediaTek returns generously with a yield of more than 8% — which puts it in the top quartile of dividend payers in Taiwan — and payouts have been increasing. The most recent spike in payments was spurred by the bumper performance in 2021 and 2022.

Dividend amounts have closely followed earnings per share, and then some given that the payout ratio has risen to 85%. The upcoming dividend on January 31 will yield 7.4%; the 4-year special dividend programme will continue till the end of 2024.

Takeaway

For the longest time, MediaTek had been number one in fabless design in the Taiwanese market. Now it is no longer the largest player, but remains the forerunner as far as research and development is concerned, with new focus on automotive and AI technologies.

With growth softening, the management seems pressured to maintain shareholder payouts. However, TWSE:2454 is still performing: it generated a 32% price return in one year. (The 3-year record is less impressive at just 5%, mostly due to Covid-time exuberance.)

Despite the slowing momentum, MediaTek is a great stock to own for the long run. In the last five years, investors made 406% in total. Muslim investors looking for halal income can expect to make more of the same in years to come.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.

For other halal income stocks, go to:

Tayyib 20: High-Yielding Halal Dividend Stocks

There is no shortage of advice out there on how to invest for income. Dividend stocks are an easy starting point. But with extra requirements to satisfy, such as those of Shariah compliance and sustainability, things start to get much trickier. With this in mind, Tayyib Finance presents its first installation of high-yielding halal dividend stocks repre…