Sustainable Halal Income Stocks in Singapore

The ready list offered by FTSE’s Shariah index for Singapore contains a few decent dividend contenders.

For those who are in the know, Singapore is a treasure trove of high-yielding dividend stocks. The Singapore Exchange (SGX) has historically averaged close to 4%, much higher than S&P 500 or FTSE 100 with around 2% each.

The difficulty for Muslim investors is discerning which are halal and which are not. In fact, halal ones — never mind tayyib — are not easy to come by. One relatively new index has made the task slightly less troublesome.

FTSE ST Singapore Shariah Index gathers halal stocks listed on the Main Board of SGX based on screening criteria by Yasaar, a Shariah consultancy. (It should be noted that their rules are somewhat different from those of AAOIFI, the main standard-setting body for Islamic finance.)

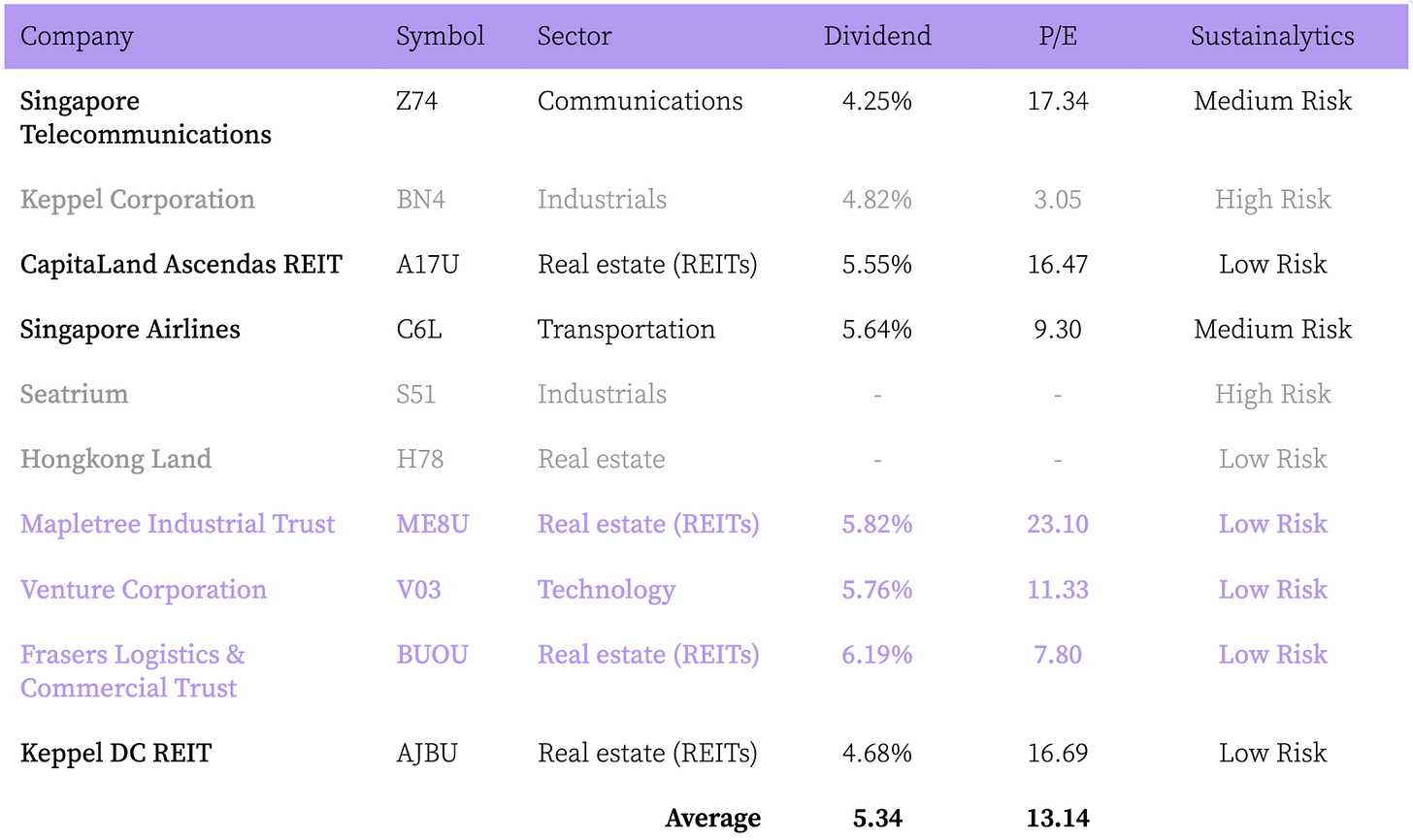

Although the full list of index constituents is not publicly available, FTSE does publish factsheets which contain the top ten Shariah compliant stocks by market capitalisation. As of end-August, the largest ten out of 36 companies made up 80% of the index.

Shortlisting for halal income stocks

The task at hand is finding Shariah compliant dividend opportunities that are reasonably priced, with an added layer of sustainability screening.

To begin with, I would remove Seatrium (SGX:S51) and Hongkong Land (SGX:H78): both are currently unprofitable and don’t pay dividends.

On to ESG credentials compiled by SGX: all fulfill my basic requirement — up to Medium Risk as rated by Sustainalytics — except for Keppel (SGX:BN4) that is High Risk and edging higher.

Of the remaining tayyib stocks, four are real estate investment trusts (REITs) and the other three, one each in communications, transportation and technology.

The REITs are all Low Risk and, given their inherent focus on shareholder returns, include the two highest dividend payers of the entire cohort.

Frasers Logistics & Commercial Trust (SGX:BUOU) pays the most at 6.19%. It also happens to be the cheapest REIT with a price-to-earnings ratio of 7.80.

Mapletree Industrial Trust (SGX:ME8U) has the second highest yield with 5.82% but comes at the most premium valuation with a P/E of 23.10.

Rounding out the shortlist is Venture Corporation (SGX:V03) that appears the most attractive among the three non-real estate stocks, with the third highest yield of 5.76% at a price of 11.33 and a Low Risk sustainability rating.

Of course, because this selection rests purely on the limited information in the table, it is essential that each halal dividend stock is assessed on financial performance and growth outlook individually in greater detail. More on that in future posts.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.